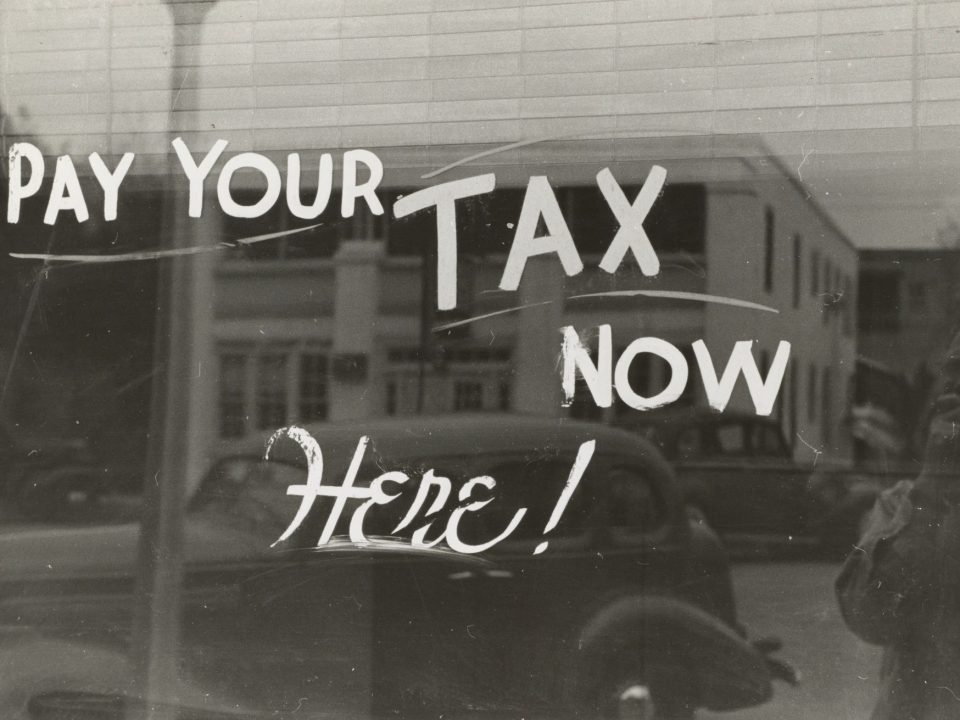

4 Tax Strategies You Can Implement at the End of the Year That Could Save You Money

As you look into tax-saving options for your investments, you should have your financial advisor work with your tax advisor so they can give you more personalized advice about your financial goals. But there are some things you can do at the end of the year that could save you money on your taxes. Here […]